Search Less.

Close More.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

business,sales,team,revenue

Our Products

Crunchbase Starter

Search, track, and monitor companies you care about using best-in-class private company data.

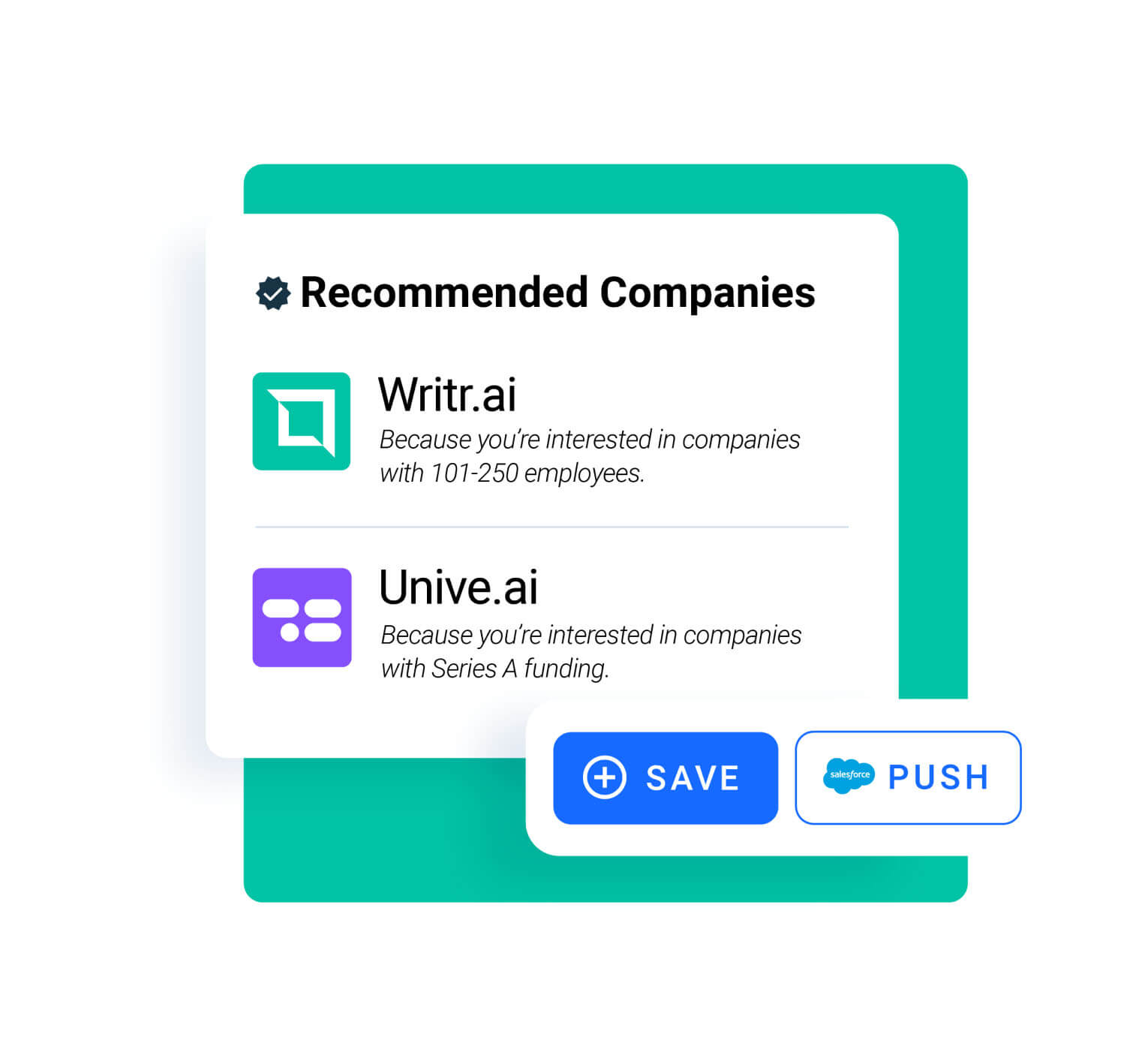

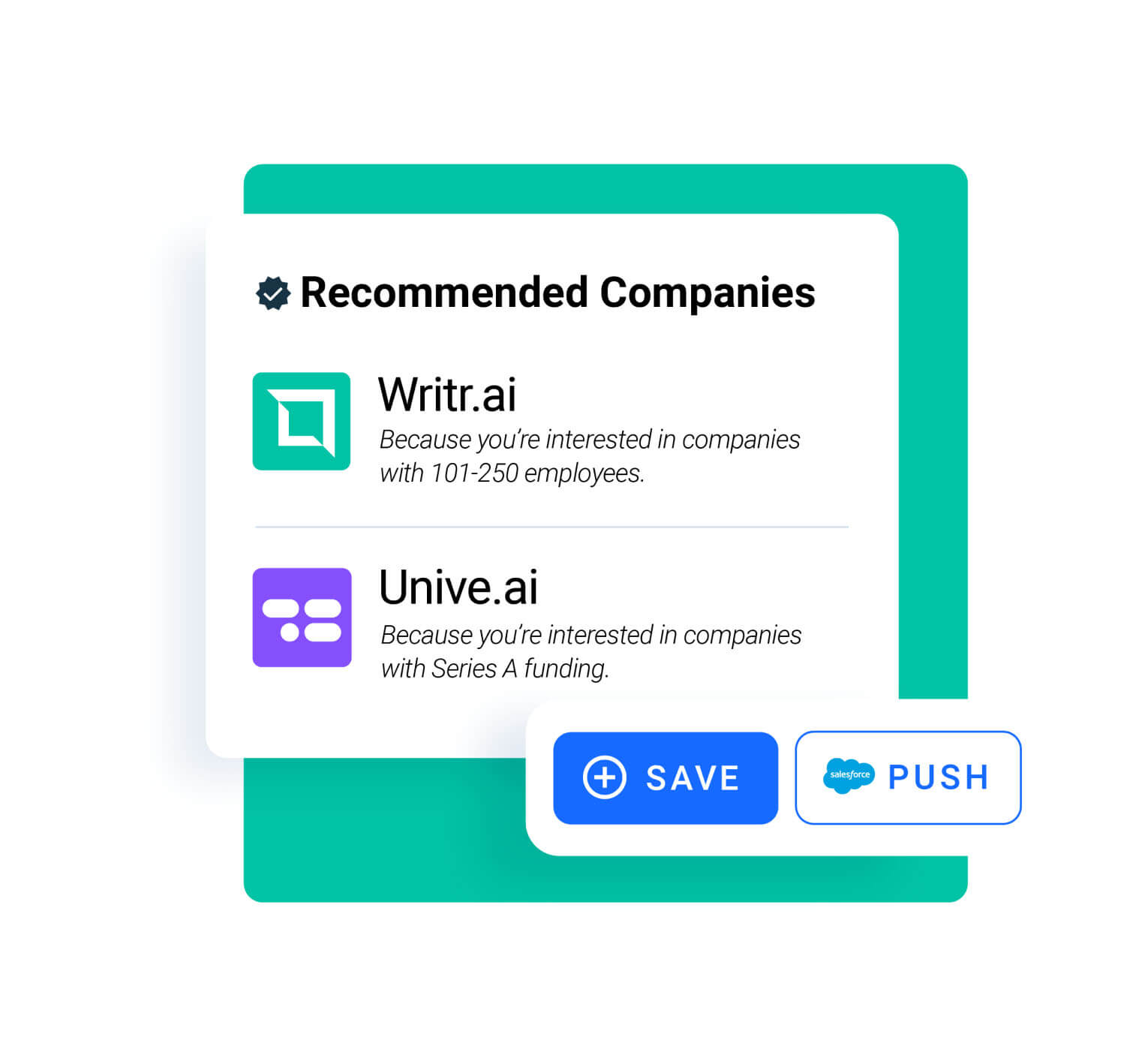

Crunchbase Pro

Find and close deals faster with relevant account recommendations, account qualification tools, and key integrations to streamline your prospecting.

Crunchbase Enterprise

Power entire prospecting teams with access to account discovery, qualification, contact identification, and outreach tools. Plus, CRM integrations, custom exports, and hands-on support from our

customer team.

Our Customers

“Automated, outbound campaigns are only as effective as the list they’re targeting. With unique funding data and other insights, Crunchbase Enterprise is the best way for us to create targeted lists of newly-funded accounts that are ready to buy.”

“Crunchbase Pro is a tool we can use to scale our lead generation process. To grow from 100 to 1,000 customers, we have to segment our prospect base, find similar companies and new niche markets to tackle. We couldn’t do this without Crunchbase Pro.”

75M

annual visitors

4K+

venture capital firms

2K+

top news publications

75+

partners across sectors like B2B media, government and academia

Our Data

Crunchbase has best-in-class live data powered by our unique community of contributors, partners, and in-house data experts.

Data is enriched, cleansed, verified, and updated daily to ensure our customers have the latest information on private companies. And, Crunchbase is SOC 2 Type II compliant.

Interested in licensing Crunchbase data?

Company Leadership

Jager McConnell

Chief Executive Officer

Robert Conrad

Chief Technology Officer

Megh Gautam

Chief Product Officer

Marcus Lo

Chief Finance Officer

Neal Patel

Chief Revenue Officer

Kelly Scheib

Chief People Officer